Quantitative Finace

I am leveraging machine learning and deep learning models for applications in quantitative finance. My projects involve integrating Transformer models with genetic algorithms to revolutionize financial time series analysis. Additionally, I am utilizing advanced machine learning techniques combined with cloud-based data processing platforms to facilitate real-time data processing. This approach enhances the dynamic accuracy of credit card fraud detection systems.

Mixture of Experts for Stock Price Prediction

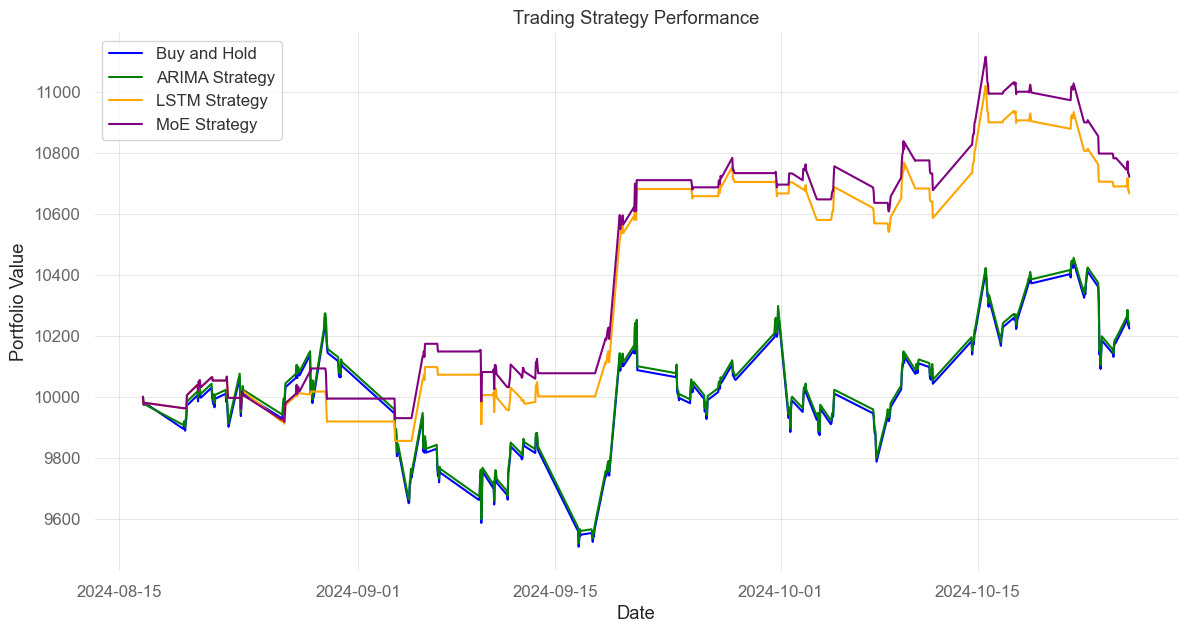

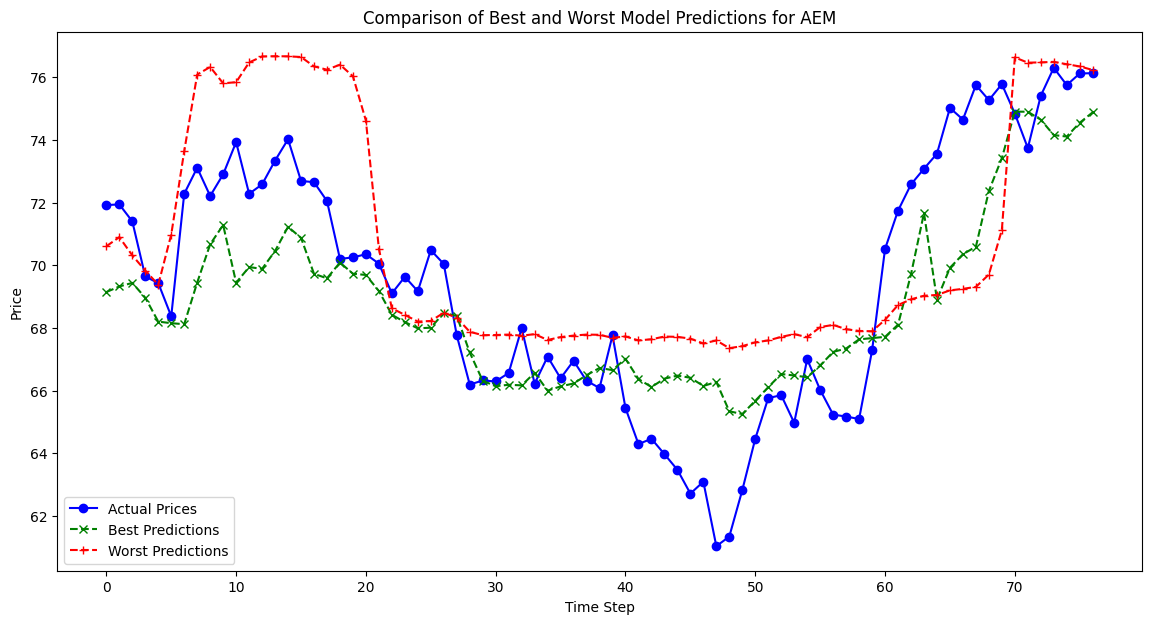

This report predicts Apple Inc.’s stock price using ARIMA, LSTM, MoE models and evaluates their performance based on accuracy and financial return. The MoE model, combining ARIMA and LSTM, delivers the best returns and stability, making it ideal for active investors. Tailored investment recommendations are provided for different investor types based on each model’s strengths and market adaptability.

Genetic Algorithms for Portfolio Strategy Optimization

This study successfully demonstrates the potential of combining Transformer models with genetic algorithms. By utilizing the advantages of the Transformer model to analyze time series data and the search efficiency of the genetic algorithm, the computational overhead is significantly reduced while improving prediction accuracy.

Real-Time Credit Card Fraud Detection

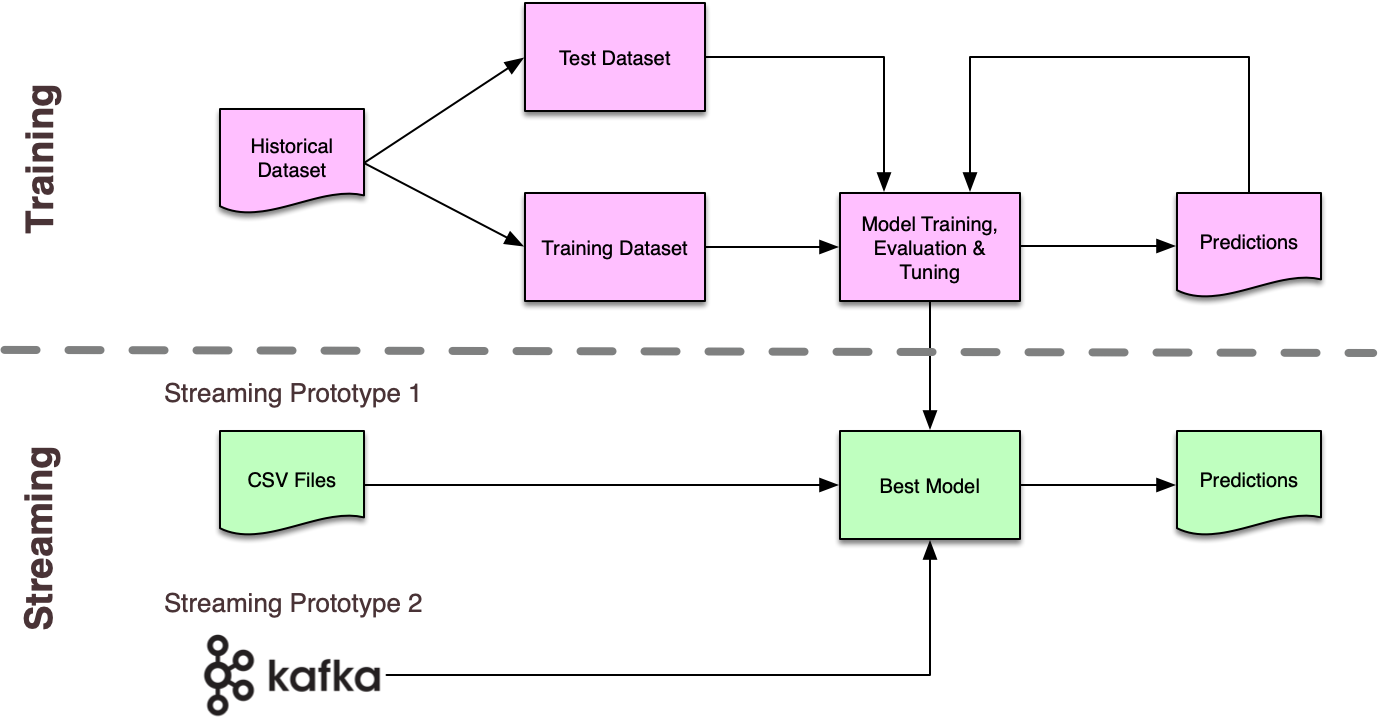

This custom project involved the implementation of a real-time framework for credit card fraud predictions. Our specific objectives were as follows: Conduct standard ML pipeline development activities, including exploratory data analysis, feature engineering, and model design and evaluation as taught in the program. Explore the techniques for streamed transaction processing and ML predictions using Spark Streaming and Kafka.